2025 Global eVTOL Battery Technology Development

I. Global Policy Race: Low Altitude Economy and Strategic Positioning

2025 global eVTOL battery industry outbreak is directly driven by the policy dividend, countries are breaking the ice through legislation and financial support to seize the right to develop standards:

China eVTOL battery:

Low-altitude economy is positioned as a “strategic emerging industry”, and the Civil Aviation Administration’s “14th Five-Year Plan” specifies that the market size will reach 1.8 trillion yuan in 2030, and the demand for eVTOL batteries will be 112.5GWh (in 2035).

Local pilot deepening: Shenzhen to build “R & D – manufacturing – operation” of the whole chain, Shanghai released the “Low Altitude Intelligent Networking 5G construction specifications”, Changsha to promote the “1 + 9 + N” take-off and landing network (including fast charging / energy storage system).

Europe and the United States eVTOL battery:

FAA to SC-VTOL validation framework + 20 billion U.S. dollars infrastructure fund to support Joby and other enterprises airworthiness;

EU “Horizon Europe” plan to invest hundreds of millions of euros in R & D funds, EASA SC-VTOL-01 standard to accelerate Volocopter certification.

Middle East eVTOL Battery:

UAE’s “Desert Oasis” plan to open up airspace + $5 billion fund to attract Chinese companies (e.g. $1 billion order from Timeless Technology).

Engineer’s insight: policy focus has shifted from “technical verification” to “airworthiness certification and infrastructure support”, China has a head start in large-scale application scenarios, but Europe and the United States still dominate the discourse on safety standards.

II.The market explosion: orders, capacity and supply chain reconstruction

In 2025, eVTOL battery market size exceeds USD 1.5 billion (CAGR 55%), the core driving force is:

Order blowout:

Global orders exceed 2,000 frames (2025), with China accounting for 60% (dominated by Yihang), and the Middle East’s single order reaches 1 billion dollars (Timeless E20 model).

Capacity Expansion:

Nintendo Times German factory went into production, YWL expanded from 1GWh to 5GWh (by the end of 2025), Xinjie Energy 5GWh solid state battery base started.

Supply chain to the sea:

Chinese battery material companies cut into the global chain:

- ✅ Rongbai Technology’s high-nickel ternary enters the Middle East market

- ✅ Bertram’s silicon-carbon anode gets aviation certification

- ✅ Enjie’s PI-based diaphragm withstands temperature of 250℃.

Data Anchor: Global eVTOL Battery Demand of 30GWh in 2030 (GGII), with China accounting for more than 50%, prying trillions of dollars of low-altitude economy 26.

III. Technology Attack: Cracking the Impossible Triangle of “High Energy, High Safety and Long Life”.

1. Dual-track breakthroughs in solid-state batteries for drones

| technical approach | energy density | cycle life | safety | representative company |

|---|---|---|---|---|

| Semi-solid state battery | 330-350 Wh/kg | 4000times | Passed needle test | EVE Energy, Funeng Technology |

| Solid-state sulfide | 400-500 Wh/kg | 1000+times | No fire in 250°C heat chamber | Toyota |

| Polymer/oxide | 350-450 Wh/kg | 2000+times | 200°C heat stability | QuantumScape |

Innovation Focus:

- Material system: lithium-rich manganese-based anode (energy density ↑20%), silicon and carbon composite anode (specific capacity 1500mAh/g), oxide/polymer composite electrolyte;

- Structural design: Xinjie Energy’s HICORE electrolyte + TIE interface regulation technology, solving the pain point of uncontrolled lithium-metal negative electrode interface5.

2. Thermal management technology leap

eVTOL’s vertical take-off and discharge rate reaches 4-6C (far exceeding 0.1-1C for electric vehicles), forcing innovation in heat dissipation solutions:

- Passive cooling system: Nanjing University of Aeronautics and Astronautics develops “flat heat pipe + pressurized air” program, temperature control without power components ≤ 38.5 ℃ (temperature difference <4 ℃), weight reduction of 40%;

- Multi-Loop Intelligent Cooling (MLICS): zoning control of motor/battery/electronic equipment heat load, supporting 240kW transient power.

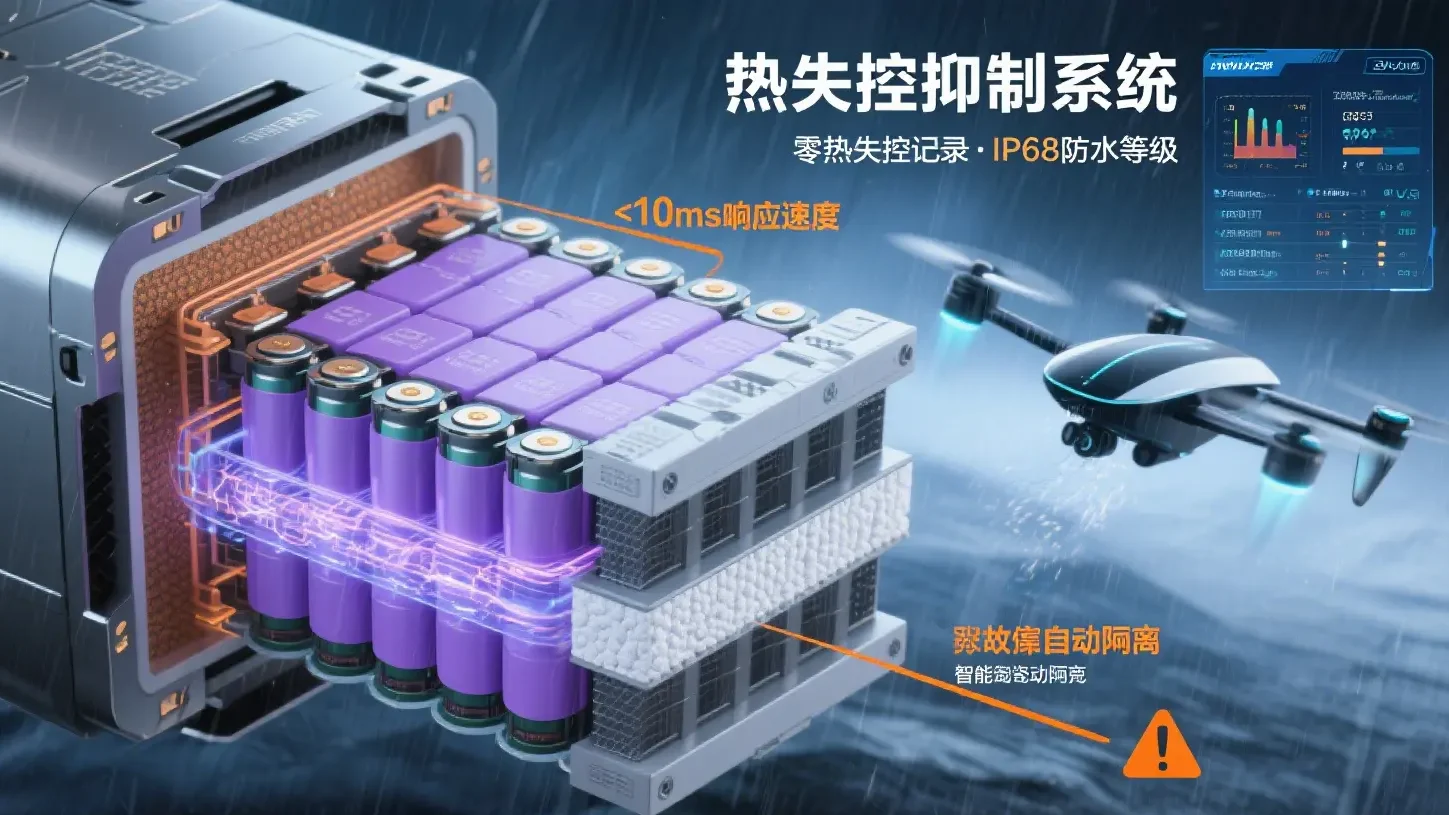

3. Safe and redundant design

- Digital Twin Early Warning: Build battery health model to predict failure 200-300 hours in advance;

- Thrust Redistribution: Joby triple/quadruple redundancy system for safe landing despite single motor failure.

IV. Airworthiness Certification: Global Standard Fragmentation and Breakthrough Paths

| airworthiness authority | Core standards | Key technical requirements | progress |

|---|---|---|---|

| CAAC | Three certificates for airworthiness of unmanned aircraft | Thermal runaway smoke does not harm occupants | EHang EH216-S receives first certification in the world |

| FAA | RTCA DO-311A | Advancing thermal runaway suppression systems | Joby certification 50% complete |

| EASA | SC-VTOL-01 | Catastrophic failure rate ≤ 10⁻⁹ | Volocopter Paris Olympics Demonstration |

Certification pain points and countermeasures:

- Lack of standards: develop “multi-cell chain thermal runaway” module-level pinning test to make up for the gap of DO-311A;

- Excessively long cycle time: adopt “financial leasing+certification binding” mode (e.g., Time’s Technology has been granted 7.1 billion yuan by Bank of China (BOC) Golden Lease for payment in installments);

- Mutual recognition barriers : Middle East accepts CAAC/EASA dual certification, accelerating Chinese standards to go overseas (takes 12-18 months for validation).

V. Challenges and Future Technology Roadmap

Core Bottlenecks

Solid-state battery industrialization: sulfide interface impedance challenges, manufacturing cost >$300/kWh (4 times of traditional batteries);

Infrastructure gap: low coverage of Vertiport charging stations (500 planned for China in 2027), need to support 5C fast charging;

Extreme environment adaptation: thermal management system performance degradation under -20℃~40℃ temperature difference (salt spray corrosion in South China Sea exacerbates challenges).

Technology Evolution Path

| stage | technology-driven | energy density | cost target | application scenarios |

|---|---|---|---|---|

| Short-term (2025-2027) | Semi-solid state battery | 400 Wh/kg | $200/kWh | Urban short-distance logistics/sightseeing |

| Mid-term (2028-2030) | All-solid-state battery | 500 Wh/kg | $150/kWh | Intercity commuting/humanoid robots |

| Long term (2030+) | Lithium-sulfur/lithium-air batteries | 800 Wh/kg | <$100/kWh | Intercity freight/extended flight time |

Engineers assert that for every 10% increase in energy density, the eVTOL application radius expands by 100 kilometers – solid-state batteries are the only key to unlocking the trillion-dollar market for low-altitude economy.

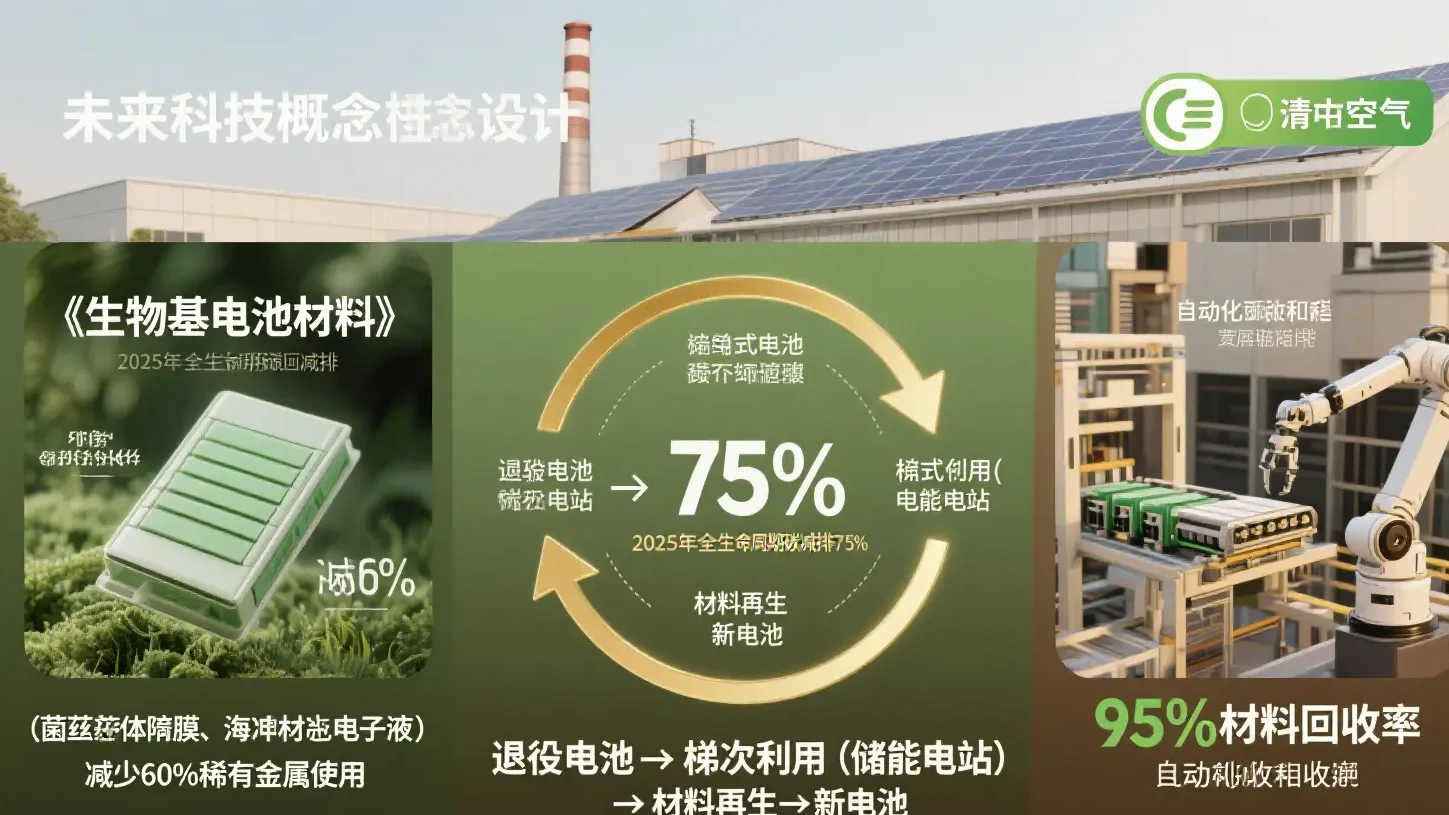

Strategic recommendation: technology cost reduction and ecological synergy

- 1. Battery companies: build a dual-track technology tree of “semi-solid-all-solid” and develop aviation-specific platforms (e.g., Ningde Times cohesive batteries);

- 2. Aircraft manufacturers: adopt multi-source supply strategy (e.g. Yihang mixes cylindrical and soft pack batteries) to diversify technical risks;

- 3. Policy development: set up a national laboratory for low-altitude batteries, and promote the adoption of Chinese standards by international organizations such as IATA.

Future Winning Point: 2027 will be the inflection point of eVTOL commercialization, and the country that masters the core technology of solid-state batteries will dominate the airspace rule-making power.