Silicon Anode Battery Breakthrough Extends Drone Flight Duration

450Wh/kg Ultra-High Energy Density Battery Delivers 90% Flight Time Boost for Drones; Low-Altitude Economy Market Projected to Reach 1.5 Trillion Yuan by 2025

In September 2025, Amprius Technologies, a leader in silicon anode battery technology, announced a procurement order exceeding $35 million for its SiCore® batteries from a top-tier drone system manufacturer. This marks another major breakthrough following a $15 million order secured in February this year.

This transaction validates strong market demand for high-energy-density drone battery technology and signals imminent explosive growth in the low-altitude economy. With continuous advancements in battery technology and increasingly supportive policy environments, drones and electric vertical takeoff and landing (eVTOL) aircraft are emerging as key application areas for new energy batteries.

I. Silicon Anode Batteries Break Through Energy Density Bottleneck

Energy density is a key factor limiting drone performance. Amprius’ SiCore battery achieves a mass energy density of 450Wh/kg and a volumetric energy density of 950Wh/L, providing up to 80% more energy storage compared to traditional graphite anode lithium batteries.

This technological breakthrough extends drone flight endurance by 90%, enabling missions lasting up to 4 hours without added weight—fundamentally resolving the industry’s endurance challenge. For high-end applications like High Altitude Platform Stations (HAPS) and Medium Altitude Platform Stations (MAPS), this performance enhancement is revolutionary.

The core advantage of silicon anode technology lies in material properties: silicon stores over ten times more lithium ions than graphite. Amprius successfully translates this theoretical advantage into commercial products through proprietary technology. Its SiMaxx product line has even achieved third-party verified performance metrics of 500Wh/kg and 1300Wh/L.

II. Low-Altitude Economy Market Enters Explosive Growth Phase

The global unmanned aerial vehicle (UAV) systems market reached $26.6 billion in 2024 and is projected to grow to $48.3 billion by 2030, with a compound annual growth rate (CAGR) of 10.5%. UAV systems account for over 57% of the low-altitude economy-related market, with North America contributing more than 45% of global revenue.

China’s market is also experiencing rapid growth. The country’s low-altitude economy market size reached RMB 505.95 billion in 2023, expanding to RMB 670.25 billion in 2024. It is projected to hit RMB 1.5 trillion in 2025 and potentially exceed RMB 3.5 trillion by 2035.

Over 30 provinces nationwide have incorporated the low-altitude economy into their development plans, with cities like Shenzhen, Guangzhou, and Chengdu taking the lead in establishing urban air mobility pilot zones. Policy support remains a key driver for the sector’s growth, with “low-altitude economy” being included consecutively in China’s Government Work Reports for 2024 and 2025.

III. Diverse Application Scenarios Drive Battery Technology Demand

Drones’ battery requirements are expanding from consumer-grade to industrial-grade and military-grade batteries, imposing higher demands on battery performance.

In the defense sector, Amprius has secured a $1.05 million Defense Innovation Unit (DIU) award and a $1.9 million U.S. military SiMaxx technology contract, demonstrating the reliability of its battery technology in critical mission applications.

Logistics delivery represents another critical application. The Hengqin pilot project in Zhuhai enables cross-border drone logistics, achieving “one-hour delivery” to Macau. Island regions utilize drones for cross-sea transport of high-value seafood, overcoming traditional logistics bottlenecks.

In emergency response, drones complement helicopters in a “high-low coordination” approach, playing vital roles in firefighting, rescue operations, and medical evacuations. Chengdu Shuangliu’s Low-Altitude Emergency Rescue Center has established a comprehensive regional response system.

IV. Power Batteries Account for 20% of eVTOL Value

As an emerging sector in the low-altitude economy, eVTOL (electric vertical takeoff and landing) aircraft demand exceptionally high battery performance. Power batteries constitute approximately 20% of an eVTOL’s total value, presenting significant growth opportunities for high-performance battery technology.

The eVTOL industry is projected to reach approximately RMB 3.2 billion in 2024, with explosive growth potential expected to surge to RMB 9.5 billion by 2026. EHang’s EH216-S has secured the world’s first operational certification and commenced paid passenger services, while CITIC Helicopter has launched five low-altitude tourism routes including Shenzhen-Zhuhai.

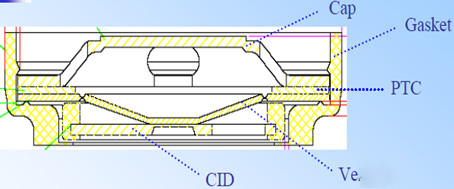

Battery technology faces heightened challenges in the eVTOL sector: beyond high energy density, it demands stringent safety standards and rapid charging capabilities. Amprius has demonstrated technology capable of charging to 80% capacity within 6 minutes, a performance validated by independent third-party laboratories and multiple aerospace companies.

V. Drone Battery Capacity Expansion and Supply Chain Layout

To meet growing market demand, Amprius has established a global contract manufacturing network with over 1.8GWh of production capacity. This includes strategic agreements in South Korea to support rapid growth in aerospace, defense, and electric mobility markets.

The company delivered strong financial performance: Q1 2025 revenue reached $11.3 million, a 383% year-over-year increase; Q2 revenue reached $15.07 million, a 350% year-over-year increase. This growth stems from expanded contract manufacturing scale, increased capacity at the Fremont pilot line, and contributions from major contracts.

Chinese battery companies are also actively positioning themselves. CATL has developed a 500Wh/kg solid-state battery, already installed in a 4-ton electric aircraft; Wolong Electric Drive’s 100kW-class aviation motors have entered COMAC’s supply chain.

VI. Technological Trends and Future Outlook

According to the Ministry of Industry and Information Technology’s roadmap, mass production of 400Wh/kg-class aviation lithium batteries will be achieved by 2025, with 500Wh/kg-class products completing validation. Amprius’s current technological capabilities have already far surpassed these targets, positioning the company to seize opportunities in the industry upgrade.

Industry projections indicate that with advancements in solid-state battery technology, energy density will surpass 500Wh/kg by 2027, extending flight endurance beyond two hours. The sulfide route is anticipated to dominate the market, capturing over 60% share.

The future low-altitude economy will exhibit diversified development: the Yangtze River Delta region will focus on technological leadership and diverse application scenarios; the Pearl River Delta region will leverage its manufacturing foundation to build a dual-engine model of “manufacturing + application”; while the Chengdu-Chongqing region will concentrate on specialized scenarios such as mountain logistics and emergency firefighting.

The low-altitude economy has emerged as a key representative of new productive forces, comprehensively reshaping traditional economic models. With continuous breakthroughs in battery technology and expanding application scenarios, drones and eVTOLs will become increasingly integrated into our daily lives.

Custom drone battery manufacturers must seize this historic opportunity by increasing R&D investment, scaling up production capacity, and deepening industrial collaboration to collectively advance the high-quality development of the low-altitude economy. Only enterprises that master core technologies and possess large-scale production capabilities will stand out in this wave of industrial transformation.