Solid State Batteries Empower eVTOL

High energy density and aviation-grade safety standards are redefining the power system for low-altitude transportation.

As the global low-altitude economy circuit continues to heat up, eVTOL (electric vertical take-off and landing vehicle) is rapidly moving from concept to commercial reality. As the “heart” of eVTOL, eVTOL power battery technology directly determines the range, load and safety performance of the vehicle, and has become a key constraint for industrial development.

I. Market Prospect: eVTOL brings new blue ocean of lithium batteries

The commercialization process of eVTOL has pressed the “accelerator button”, and domestic and international orders have landed intensively, giving rise to GWh-level demand for power batteries. According to GGII forecast, by 2030, eVTOL, as a new application scenario, will bring 30GWh demand growth for lithium batteries.

Chen Liquan, academician of the Chinese Academy of Engineering, clearly pointed out that eVTOL will become a new blue ocean market for the lithium battery industry, injecting strong vitality into the industry’s growth. This emerging market has attracted the active layout of battery manufacturers such as Ningde Times, Yiwei Lithium Energy, Xinwangda, Zhengli Xinneng, Xinjie Energy and so on.

Supply chain synergy effect is remarkable. The relevant person in charge of Wofei Changkong pointed out that “eVTOL industry will share 80% of the supply chain of new energy vehicles”. This means that in terms of core materials, production equipment, manufacturing processes, etc., eVTOL power battery can draw on the mature experience of new energy vehicle batteries, accelerating the industrialization process.

II. Technical Challenge: “Three Highs and One Fast” Requirements for Aviation-Grade Batteries

eVTOL battery belongs to aviation-grade products, and its standard is much stricter than that of automobile battery. Jiang Kecheng, Chief Scientist of Zhengri New Energy, emphasized that the aviation power battery in the field of eVTOL must achieve the comprehensive performance breakthrough of “three highs and one fast”: i.e., high energy density, high power, high safety and fast charging.

High energy density is the key to ensure that eVTOL can realize long flight range. Currently, the energy density of leading solid-state batteries has reached 400-500Wh/kg, far exceeding the 350Wh/kg limit of liquid batteries.7 The energy density of cohesive semi-solid-state batteries developed by Ningde Times has reached 500Wh/kg, and the pilot line of full-solid-state batteries has been completed.

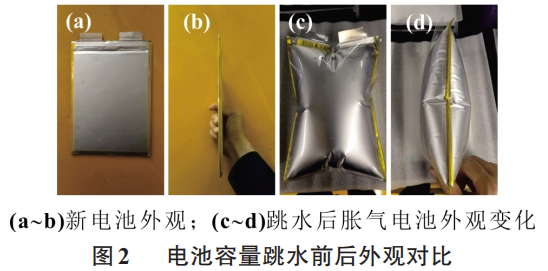

High safety is a top priority in aviation. Solid-state batteries adopt solid-state electrolyte instead of liquid electrolyte, which fundamentally solves potential safety hazards such as leakage and combustion.5 BYD’s all-solid-state samples have passed the pin-prick test, demonstrating excellent safety performance.7 The company has also developed an all-solid-state battery with an energy density of 500Wh/kg, and the pilot line of all-solid-state battery has been completed.

The person in charge of China Innovation Aviation said, “The eVTOL market is still in its infancy, with high barriers to entry for OEMs, long R&D cycles, and great difficulty in obtaining airworthiness certificates, and equally long R&D and validation cycles for supporting suppliers.”

III.Solid-state battery technology path: diversified development pattern

The global solid state battery R&D presents a parallel development situation of multiple technology routes:

Sulfide route (Ningde Times/Toyota) has the advantage of the highest ionic conductivity (0.01S/cm), which is close to the level of liquid batteries, but the challenge is the generation of highly toxic H2S in contact with water.

The oxide route (QuantumScape/BYD) has the advantage of the best chemical stability, but faces the challenge of high interfacial impedance.

The polymer route (Tsing Tao Energy/Shanghai Automobile) has the advantage of the lowest processing cost, but poor high-temperature performance.

Domestic companies mostly adopt a progressive development strategy from semi-solid to full-solid. More than 60% of enterprises have two or even three technology routes, and relatively few have only one technology route.

IV. Commercialization process: 2025 to become a key node

2025 is expected to be the first year of eVTOL’s commercialized operation.6 Solid-state battery application cases are beginning to emerge:

Yihang Intelligence cooperated with Xinjie Energy to carry solid-state batteries with an energy density of 480Wh/kg on the EH216-S, realizing a 48-minute and 10-second flight test with a 60%-90% increase in range.

Ganfeng Lithium announced that its solid-state batteries have been used in some models of trial vehicles and mass production, and applied to well-known drones and eVTOL enterprise cooperation products.

Ningde Times strategically invested in Peak Flight Aviation to jointly promote battery research and development in the eVTOL field, aiming to further improve the energy density and overall performance of the battery.

The industry expects 2027 to be the first year of low-altitude manned flight, becoming the first major scenario for the commercialization of semi-solid and solid-state battery technology.

V. Hybrid route: a pragmatic choice in the transition stage

In the stage where solid-state batteries are not yet fully mature, the hybrid route has become a pragmatic choice for some manufacturers. Xue Yan, Vice President of Strategy of Dream Chaser, pointed out that “the energy density of fuel is much higher than that of batteries, and even if the work efficiency of the internal combustion engine is 30%, its energy density is 10 times that of batteries, which is hard to replace”.

Hybrid drives offer three significant advantages:

- High-frequency take-off and landing capability: low-altitude transportation has frequent take-offs and landings, and the hybrid mode can ensure continuous high-frequency take-offs and landings

- High utilization rate: compared with pure electric power that requires frequent charging, hybrid aircraft only need to be refueled, which significantly improves the utilization rate

- Low dependence on infrastructure: only need to be equipped with fuel charging facilities in the take-off and landing sites, which significantly reduces the cost of infrastructural inputs

Li Zhen, senior director of product development at XINWODA, said that the hybrid is expected to lower the direct cost of each airtime by 60%8. Referring to the development path of new energy vehicles, the ratio of pure electric to hybrid in eVTOL field may reach 6:4 in the future.

VI, equipment first: manufacturing process changes and opportunities

Solid state battery industrialization process, equipment link due to technology iteration and domestic substitution double drive, become the most certainty of the current investment direction.

Pilot Intelligence in 2025 half-yearly results will be mentioned, the company 24 years of all-solid-state equipment new orders of nearly 100 million yuan, 25 years H1 order volume has reached 400-500 million yuan. H2 head of the customer is expected to open the focus of the order, 25 years of the order is expected to exceed 1 billion yuan.

Solid-state battery production process is significantly different from liquid batteries, need to add new dry electrode, solid electrolyte synthesis, high temperature sintering and other equipment. Single GWh equipment investment from liquid battery 20 million yuan to 50 million yuan.

Domestic equipment manufacturers (such as pilot intelligence, Liyuanheng) has broken through the dry electrode, high-pressure molding and other core technologies, the cost is lower than overseas 30% -50%, accelerating the replacement of Japan and South Korea equipment.

VII. Industry outlook: the pattern of the $100 billion market is beginning to emerge

Morgan Stanley predicts that the global solid state battery market will exceed 120 billion U.S. dollars in 2030, of which China will account for 40% of the market share. Solid state batteries will become the new 100 billion track.

Policy level support is increasing. The Ministry of Industry and Information Technology (MIIT) has included all-solid-state batteries in the key research projects for new energy vehicles, and many places have provided R&D subsidies and tax incentives. China’s Ministry of Industry and Information Technology clear 2027 to cultivate 3-5 global leaders, Shanghai / Zhuhai subsidized equipment investment of 30%.

Technological innovation will continue to drive industry progress. Zhengris aims to address the safety and longevity challenges of higher energy density (>400Wh/kg) batteries by 2026-2027, and increase the energy density of mass-produced batteries to over 500Wh/kg by 2028-2030.

With the advancement of eVTOL commercialization, solid-state batteries will show great application potential in new energy vehicles, energy storage, eVTOL vehicles and humanoid robots, reconfiguring the three major value chains of transportation, energy and materials.