What is Solid State Battery

Introduction: The Inevitability of Technology Innovation

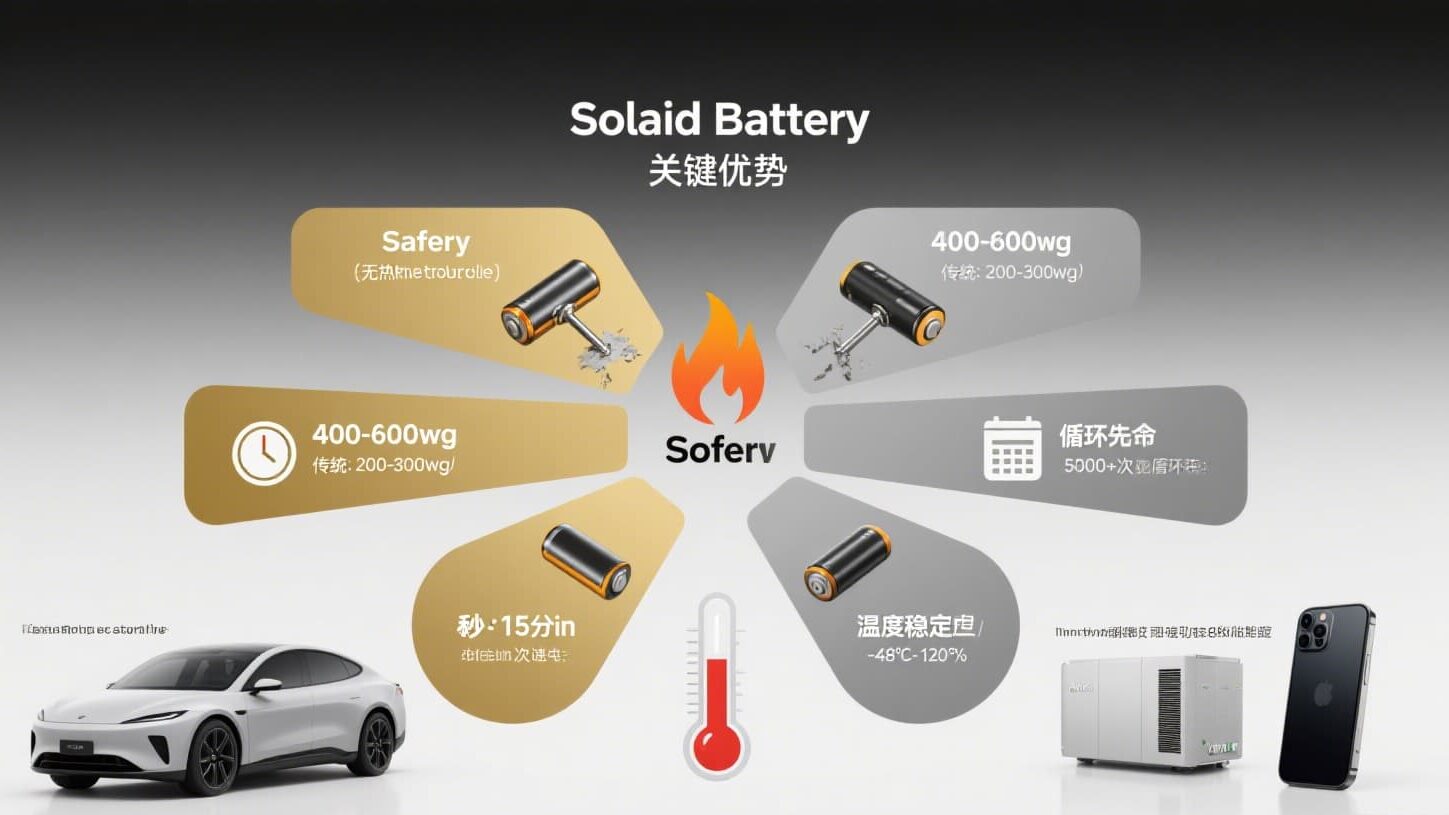

With the iteration of wireless devices, the popularization of electric vehicles and the rise of 5G/low-altitude economy, traditional liquid lithium-ion batteries have encountered bottlenecks in the balance between energy density and safety. Solid-state battery (ASSB) adopts solid-state electrolyte instead of liquid electrolyte, fundamentally solving the risk of thermal runaway, and at the same time has the potential to break through the 500Wh/kg energy density, which has become the core direction of the next generation of energy storage technology. Research organization EVTank predicts that global ASSB shipments will grow explosively from 5.3GWh in 2025 to 614.1GWh in 2030, a five-year increase of more than 100 times.

I. Solid-state battery technology route: comparison of three major electrolyte systems

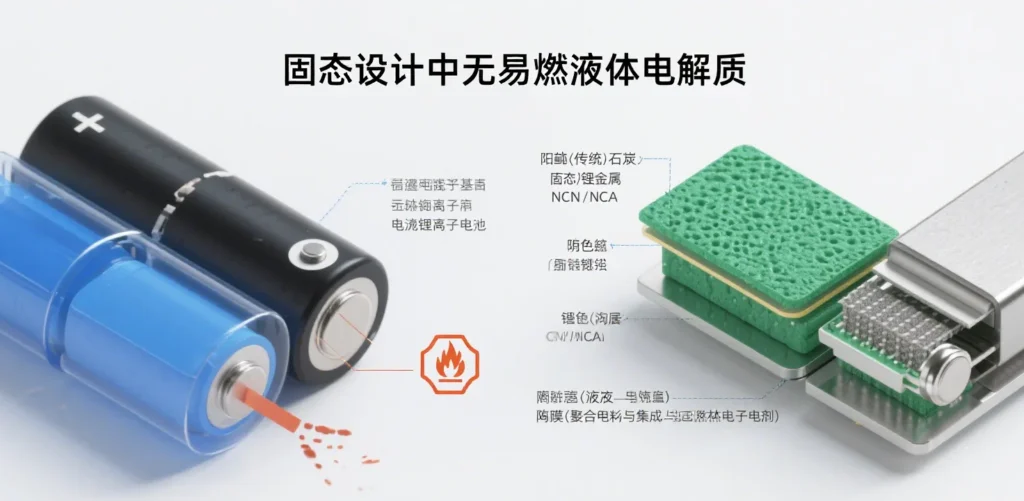

Solid-state battery core differences: ASSB replaces liquid electrolyte and diaphragm with solid-state electrolyte, and reconstructs the internal ion transfer mechanism of the battery.

The three mainstream systems of solid-state batteries:

1. Polymer electrolyte

Advantage: good flexibility, easy to process

Bottleneck: low ionic conductivity at room temperature (<10-⁴ S/cm), poor stability at high temperatures

On behalf of the R & D: Qingtao Energy (patented LPSC composite electrolyte)

2. Oxide electrolytes

Advantage: high mechanical strength, wide electrochemical window

Bottleneck: high solid-solid interface impedance, need to add liquid interface wetting agent (semi-solid solution)

Progress: Guoxuan Gaoke (LLZO film), Ganfeng Lithium (LLZTO powder)

3. Sulfide Electrolyte

- Core Advantage: Highest room temperature ionic conductivity (>10-² S/cm, comparable to liquid electrolyte)

- Challenges to Industrialization:

- Extremely sensitive to water and oxygen (generates H₂S highly toxic gas)

- Requires full dry process and inert atmosphere equipment

- Leaders: NINGDETAEK (patented sulfur-silver germanium mineral phase), BYD (interface modification technology)

Technical consensus: Mainstream automakers and battery giants are focusing on the sulfide all-solid-state route because it offers the best overall performance in terms of mass production feasibility.

II. Core material innovation: from laboratory to mass production

(1) Anode System Evolution

Current program: high-nickel ternary (NCM811/NCA)

Nickel proportion >80% to improve specific capacity, cobalt/manganese (aluminum) to maintain structural stability

Representative vendors: Rongbai Technology (monocrystalline high-nickel), Dangsheng Technology (multi-element doped)

Future direction: lithium-rich manganese-based cathode (>250mAh/g)

Advantages: cost reduction (manganese resource abundance >20 times that of nickel), cobalt-free

Key focus of the attack: to solve the problems of low first-time efficiency ( <80%), voltage degradation Key material vendors: Hongxing Development (manganese tetraoxide), key material vendors: Red Star Development (manganese tetraoxide), key materials: the first time to resolve low efficiency ( <80%), voltage degradation problem. <Tackling focus: solving low first-time efficiency (<80%), voltage decay

Key material vendors: Red Star Development (manganese tetraoxide), Xiangtan Electrochemical (EMD)

(2) Negative electrode breakthrough path

Industrialization mainstay: silicon-carbon composite anode

Specific capacity: graphite anode more than 6 times (>1500mAh/g)

Core technology: nano-silicon/silicon oxide (SiOₓ) + carbon-based cushioning substrate

Leading companies: Bertram’s (silica-oxygen cladding), Pu Tailai Lai (graphene composite)

Ultimate solution: lithium metal anode

Theoretical capacity of 3860mAh/g, but need to overcome the interface side reaction of dendrites and Interface side reaction

Transitional technology: carbon nanotube conductive network (Tenneco single-wall CNT)

(3) Electrolyte material cost dismantling

Sulfide ASSB cost core: lithium sulfide (Li₂S) accounts for 77% of the material cost

Synthesis path: sulfide iron ore → hydrogen sulfide → Li₂S (strict control of water-oxygen residue)

Main suppliers: Xiamen Tungsten Xinneng (purification process), Ganfeng Lithium (lithium resource integration)

(4) Fluid Collector Upgrade

Composite fluid collector: polymer base film (PET/PP) + double-sided nano-metal layer

Advantage: 40% weight reduction + improved safety (dendrite self-cutting)

Equipment dependence: magnetron sputtering (Proudly Ultrasonics), electroplating (Dongwei Technology)

III. Manufacturing equipment: the dry process revolution

ASSB production line changes are focused on the front/middle channel segment:

▶ Front-end process

Dry electrode technology: to replace wet coating, to avoid solvent damage to the sulfide

Core equipment: dry mixing → extrusion film → hot pressing and shaping

Representative manufacturers: Pilot Intelligent (complete line), Naknor (roller press)

▶ Mid-channel process

All-solid-state lamination: Replaces winding and adapts to brittle electrolytes

Innovative technology: Adhesive frame lamination (patented by Liyuanheng) + Isostatic densification

Equipment vendors: HEMS (laser cutting), WINNER TECHNOLOGY (laminator)

▶ Post-process innovation

High-pressure synthesis: activation of solid-solid interface ion channels (>10MPa pressure)

IV. Industrialization Process and Challenges

Mass production schedule

| company | technical approach | mass production node | application scenarios |

|---|---|---|---|

| BYD | Sulfide ASSB | 2027 | high-end electric vehicle |

| CATL | condensed state | 2026 | Geely flagship sedan |

Core Bottlenecks

- Interfacial engineering: solid-solid contact impedance >100 times that of a liquid interface

- Process cost: doubling of equipment investment for sulfide full inert atmosphere

- Supply chain maturity: Li₂S purity requirement >99.9% (current capacity is insufficient)

V. Technology Outlook: Material Breakthroughs Drive Industry Outbreaks

Short-term path:

- Positive electrode: high-nickel ternary → lithium-rich manganese-based

- Negative electrode: silicon and carbon composite → pre-lithiated lithium metal

- Electrolyte: sulfide (interface modification)

Material growth pole:

- Manganese metal: lithium-rich manganese-based core raw material (Red Star Development capacity expansion)

- Nano-silicon powder: silicon carbon anode active material (Boqian New Material plasma method)

- Single-wall carbon tubes: solving silicon anode expansion failure (Tannai Technology patent dispersion)

Engineer’s perspective: ASSB industrialization is a synergistic evolution of material-equipment-process. 2025-2026 will witness the completion of the key material standard stereotyping and dry process equipment validation for the pave the way for 100GWh level capacity in 2030.